History Nvidia Corporation (NVDA)

Nvidia Corporation is an artificial intelligence computing company. It operates through two segments: Graphics and Compute & Networking. Its Graphics segment includes GeForce graphics processing unit (GPU), the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual graphics processing unit (vGPU) software for cloud-based visual and virtual computing; and automotive platforms for infotainment systems. Its Compute & Networking segment includes Data Center platforms and systems for artificial intelligence (AI), high-performance computing (HPC), and accelerated computing; Mellanox networking and interconnect solutions; automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions; and Jetson for robotics and other embedded platforms. Its platforms address markets such as Gaming, Professional Visualization, Data Center, and Automotive.

is an American multinational technology company incorporated in Delaware and based in Santa Clara, California. It designs graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip units (SoCs) for the mobile computing and automotive market. Its primary GPU line, labeled “GeForce”, is in direct competition with the GPUs of the “Radeon” brand by Advanced Micro Devices (AMD). Nvidia expanded its presence in the gaming industry with its handheld game consoles Shield Portable, Shield Tablet, and Shield Android TV and its cloud gaming service GeForce Now. Its professional line of GPUs are used in workstations for applications in such fields as architecture, engineering and construction, media and entertainment, automotive, scientific research, and manufacturing design.

In addition to GPU manufacturing, Nvidia provides an application programming interface (API) called CUDA that allows the creation of massively parallel programs which utilize GPUs. They are deployed in supercomputing sites around the world.More recently, it has moved into the mobile computing market, where it produces Tegra mobile processors for smartphones and tablets as well as vehicle navigation and entertainment systems.[8][9][10] In addition to AMD, its competitors include Intel and Qualcomm.

Nvidia announced plans on September 13, 2020 to acquire Arm Ltd. from SoftBank, pending regulatory approval, for a value of US$40 billion in stock and cash, which would be the largest semiconductor acquisition to date. SoftBank Group will acquire slightly less than a 10% stake in Nvidia, and Arm will maintain its headquarters in Cambridge.

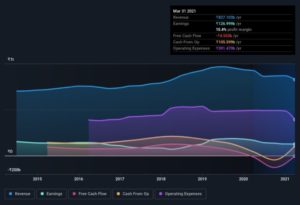

Nvidia Financial Growth Details last 15 Years

| Year | Revenue in mil. US$ |

Net income in mil. US$ |

Total assets in mil. US$ |

Price per share in US$ |

Employees |

|---|---|---|---|---|---|

| 2005 | 2,010 | 89 | 1,629 | 8.81 | 2,101 |

| 2006 | 2,376 | 301 | 1,955 | 16.76 | 2,737 |

| 2007 | 3,069 | 449 | 2,675 | 25.68 | 4,083 |

| 2008 | 4,098 | 798 | 3,748 | 14.77 | 4,985 |

| 2009 | 3,425 | −30 | 3,351 | 10.97 | 3,772 |

| 2010 | 3,326 | −68 | 3,586 | 12.56 | 5,706 |

| 2011 | 3,543 | 253 | 4,495 | 15.63 | 6,029 |

| 2012 | 3,998 | 581 | 5,553 | 12.52 | 5,042 |

| 2013 | 4,280 | 563 | 6,412 | 13.38 | 7,974 |

| 2014 | 4,130 | 440 | 7,251 | 17.83 | 6,384 |

| 2015 | 4,682 | 631 | 7,201 | 23.71 | 6,384 |

| 2016 | 5,010 | 614 | 7,370 | 53.76 | 9,227 |

| 2017 | 6,910 | 1,666 | 9,841 | 149.79 | 10,299 |

| 2018 | 9,714 | 3,047 | 11,241 | 232.38 | 11,528 |

| 2019 | 11,716 | 4,141 | 13,292 | 174.59 | 13,277 |

| 2020 | 10,918 | 2,796 | 17,315 | 395.63 | 13,775 |

Nvidia Production

Gaming and Entertainment

- GeForce Graphics Cards

- Gaming Laptops

- G-SYNC Monitors

- SHIELD

Laptops and Workstations

- Gaming Laptops

- NVIDIA RTX Desktop Workstations

- NVIDIA RTX in Professional Laptops

- DGX Station

- NVIDIA RTX Data Science Workstation

- Studio Laptops

Cloud and Data Center

- Grace CPU

- DGX Systems

- EGX Platform

- HGX Platform

- DRIVE Constellation

Networking

- DPU

- Ethernet

- InfiniBand

GPUs

- GeForce

- NVIDIA RTX / Quadro

- Data Center

- Titan RTX

Embedded Systems

- Jetson

- DRIVE AGX

- Clara AGX

Nvidia’s family includes graphics, wireless communication, PC processors, and automotive hardware/software.

Some families are listed below:

GeForce, consumer-oriented graphics processing products

Nvidia RTX, professional visual computing graphics processing products (replacing Quadro)

NVS, multi-display business graphics solution

Tegra, a system on a chip series for mobile devices

Tesla, dedicated general-purpose GPU for high-end image generation applications in professional and scientific fields

nForce, a motherboard chipset created by Nvidia for Intel (Celeron, Pentium and Core 2) and AMD (Athlon and Duron) microprocessors

Nvidia GRID, a set of hardware and services by Nvidia for graphics virtualization

Nvidia Shield, a range of gaming hardware including the Shield Portable, Shield Tablet and, most recently, the Shield Android TV

Nvidia Drive automotive solutions, a range of hardware and software products for assisting car drivers. The Drive PX-series is a high performance computer platform aimed at autonomous driving through deep learning, while Driveworks is an operating system for driverless cars.

BlueField, a range of Data Processing Units, initially inherited from their acquisition of Mellanox Technologies

Nvidia Datacenter/Server class CPU, codenamed Nvidia Grace, coming in 2023.

Expecting Nvidia stock price will Be a Trillion-Dollar Stock

Key Points

Gaming represents the lion’s share of Nvidia’s business.

The company’s data center business is a key growth driver.

Nvidia has other opportunities under the hood.

There’s little question that Nvidia (NASDAQ:NVDA) has been one of the market’s star performers in recent years. Over the past three years alone, Nvidia stock has more than tripled — and that isn’t just a recent phenomenon. During the most recent five and 10-year periods, the stock has gained 1,280% and 5,110%, respectively (as of this writing). The stock has grown so quickly in recent years, Nvidia felt compelled to split its shares.

Past performance is no guarantee of future results, but it gives investors a starting point. The question becomes, does Nvidia have what it takes to continue its winning streak or have investors already missed the boat? I won’t bury the lede here: I think Nvidia has what it takes to surpass a trillion-dollar market cap by 2025. Here’s why.

Nvidia has no equal, When it comes to gaming

It’s hard to overstate Nvidia’s dominance of the gaming space with its cutting-edge graphics processing units (GPUs). The company commands an 81% share of the discrete desktop GPU market and is the processor of choice among hardcore gamers.

The reason? Nvidia pioneered the GPU (in its current form) and continues to spend heavily on research and development (R&D) to create the next generation of state-of-the-art processors. Don’t take my word for it. In its fiscal 2022 first quarter (ended May 2, 2021), Nvidia spent $1.15 billion — more than 20% of its total revenue and 31% of its gross profit — on R&D. The company is that serious about maintaining its technological advantage.

Nvidia’s financial results show that its strategy is sound. The company delivered record gaming revenue of $2.76 billion in Q1, up 106% year over year. Gaming chips represent the lion’s share of Nvidia’s sales, accounting for 49% of current revenue. History shows that there will be peaks and valleys in demand for gaming chips, but Nvidia’s continue to be the most highly sought after.

Nvidia corporation’s head is in the clouds

While processors for gaming represent the bulk of Nvidia’s business, the company’s data center segment is catching up fast. The GPU’s super power is parallel processing — which allows it to run legions of complex mathematical computations simultaneously. This not only helps render life-like images in video games, but works equally as well routing information to and from a data center at lightning speeds.

Nvidia’s GPUs are the unheralded workhorse of the data center, the top choice of the biggest names in cloud computing. Microsoft’s Azure Cloud, Alphabet’s Google Cloud, and Amazon’s AWS all rely on Nvidia GPUs to move data — as do a host of other top cloud operators.

There’s another reason these cloud leaders all use Nvidia chips in their data centers. Researchers discovered that in order to train and run artificial intelligence (AI) systems, they needed the fastest processors available. The sheer number-crunching capabilities of Nvidia GPUs is unmatched, and as AI becomes a staple of cloud computing, Nvidia processors became something of a must-have.

Nvidia’s results tell the tale. The company generated record data center revenue of $2.05 billion in the first quarter, up 79% year over year, and accounting for 36% of its total sales.

Nvidia’s Other growth catalysts

The one-two punch of gaming and cloud computing would be reason enough to invest in Nvidia, but the company has other irons in the fire. Autonomous driving is another technology that requires processing done in the blink of an eye.

Nvidia has partnered with more than 370 companies in the automotive industry to take self-driving technology from the drawing board to mass production. The list includes top-shelf car and truck manufacturers, tier 1 auto suppliers, mobility services, sensor companies, and HD mapping specialists that are collaborating on its Nvidia Drive system. The system combines an open autonomous vehicle computing platform with cutting-edge software that is constantly improving and evolving.

While its auto segment currently represents just 4% of Nvidia’s revenue, a breakthrough in self-driving technology could be a major catalyst to drive Nvidia to the next level.

Nvidia stock Current market cap — $480 billion

There are no guarantees that Nvidia, or any company for that matter, has what it takes to achieve the lofty market cap of $1 trillion. With a current market cap of just $480 billion (as of this writing) this semiconductor kingpin is on the verge of scaling the halfway point.

That said, given its rapid revenue growth, industry-leading position — in not one, but two markets — and the potential for more to come, Nvidia has all the necessary ingredients to take its place among the most valuable companies on U.S. public markets.

Nvidia Corporation Address

2788 San Tomas Expy

Santa Clara, CA

95051-0952

United States

https://www.nvidia.com/

Related search enquiry

- nvidia share price target

- nvidia stock split

- buy nvidia stock india

- nvidia share price india

- nvidia news

- nvda

- nvda technical analysis

- nvidia chart investing