Many investors haven’t heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company’s profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the ‘non-FCF profit ratio’.

A lackluster earnings announcement from Coal India Limited (NSE:COALINDIA) last week didn’t sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it’s not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to March 2021, Coal India had an accrual ratio of 0.84. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. In the last twelve months it actually had negative free cash flow, with an outflow of ₹4.6b despite its profit of ₹127.0b, mentioned above. We also note that Coal India’s free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of ₹4.6b.

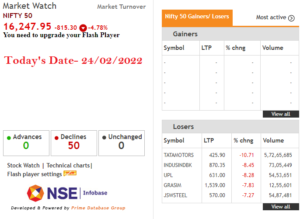

Coal India limited Performance

Coal India news : As we have made quite clear, we’re a bit worried that Coal India didn’t back up the last year’s profit with free cashflow. For this reason, we think that Coal India’s statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we’ve only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you’d like to dive deeper into this stock, it’s crucial to consider any risks it’s facing.

This note has only looked at a single factor that sheds light on the nature of Coal India’s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to ‘follow the money’ and search out stocks that insiders are buying.

Related search Query

- Coal India share price target 2021

- Coal India share price target 2022

- Coal India dividend 2021 record date

- why is Coal India share price falling

- Coal India share is good for long term

- Coal India bonus news

- Coal India dividend history

- Coal India share news