Related search Query

- How will you check if you are safe or secure in your account online

- Are online banks safe

- Are online savings accounts safe

- Reasons not to use online banking

- 5 bad things about online banking

- Safest online banks

- Are online banks FDIC insured

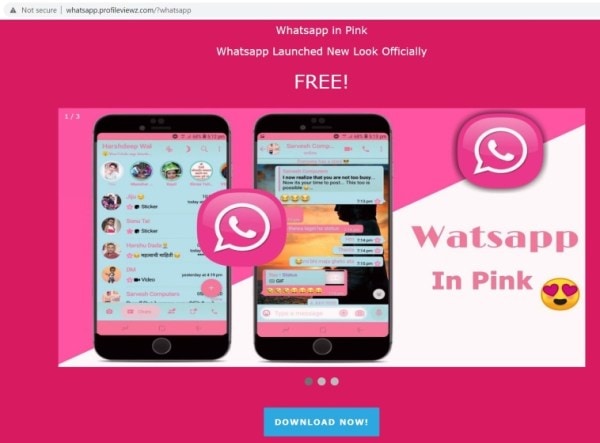

- Is online banking safe on android

Figuring out which bank you want to keep your money in or choosing one account is a big deal and the decision may sometimes be overwhelming as you are putting majority of your money for safekeeping.

Along with choosing from many of the institutions there is also another important decision to make: if you will choose the online only bank or you will keep it old school by opening an account at a traditional bank.

Traditional banking pros and cons –

Pros –

- Most of the larger banks offer one stop shopping for your financial needs. They often make it easier to take out a mortgage, open a credit card or apply for a personal loan with the same institution you bank through.

- Depending on the bank you choose, you might be supporting a local business or a nationwide business that provides jobs in your area. Mostly credit unions which are often community focused institutions provide friendly, face-to-face customer service to account holders.

- Many of the traditional bank users find it easier to walk into a bank and ask for the service they need. This might be a better option for people who find it difficult to figure out how to get what they need through an online banking portal or app.

Cons –

- Depending on the bank you choose, if you choose a local bank you will only be able to access your bank locally which can cause a problem to you if you travel frequently or eventually plan to move out of the state they are living.

- Large banks may often have higher account maintenance fees and other associated costs as they have to keep the lights on at an in-person banking facility.

- The amount you get as interest from the savings and checking account may be lower than what you would get from a digital only bank.

Online only Banking pros and cons –

Pros –

- Many online banks have no maintenance fees or balance requirements and also offer lower cost banking options as they do not have as much overheads as banks with physical facilities.

- With online banks, you are not tied to the physical location, your money goes everywhere with you as long as you have any device to access it.

- Many of the online banks do offer other financial products like mortgages and student loan refinancing.

- Many online banks offer a suite of digital tools which include built-in budget tracker, automatic savings and integration with popular third-party apps to help the customers take charge of their finances.

Cons –

The only noticeable con of online-only banking is that it does not provide in-person banking option. As for people who face difficulty in accessing the tools for digital banking it is easier to opt for a traditional bank.

No matter which banking option you are choosing, keep in mind that all banks does not provide equal facilities and are not created equally. It is important for you to do thorough research of all the features and policies of the potential bank account before signing the paper work and choose the one which appeals you the most.