Small cap stocks

I usually invest in small cap, Because in the hope that one day this small cap will become a large cap, I don’t know much about investment procedures, since students of commerce have a little knowledge about EPS, PE ration, DEBT RATIO, how many companies have shares in the market, and companies debt as well as companies expansion plan in future and sales vs profit ratio last 3 years.

Why I have invested in these 6 stocks?

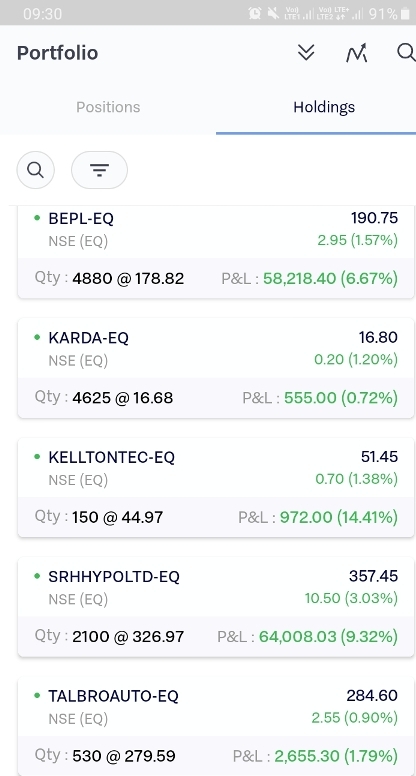

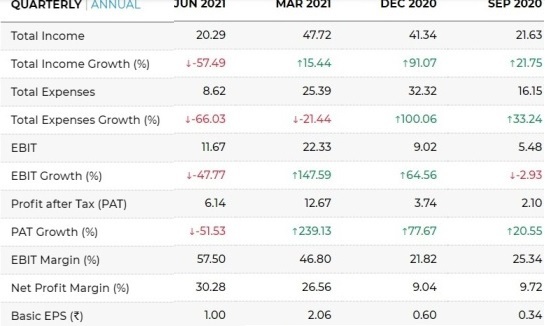

(BEPL) Bhansali Engineering Polymers – Share Price, Stock – Bhansali Engineering Polymers Ltd., incorporated in the year 1984, is a Small Cap company, operating in Petrochemicals sector.

Bhansali Engineering Polymers Ltd. key Products/Revenue Segments include ABS Resins, SAN Resins, Raw Materials. The company has a total of 16.59 Crore shares outstanding, Promoters Holding– 56.45%.

PE Ratio = 7.55, EPS-25, Total Debt to Equity – NIL, Balance sheet showing strong sales performance which increasing every quarter. Their not showing any big liabilities.

BEPL related question

>>Bhansali engg. share price

>>Bepl share price target 2022

>>Bhansali engineering polymers ltd

>>Bepl share price target 2021

>>Bhansali engineering polymers ltd wikipedia

>>Bepl share price target tomorrow

>>Bhansali engineering polymers ltd news

>>Bhansali engineering polymers ltd products

(SRHHYPOLTD) Sree Rayalaseema Hi-Strength Hypo – Share Price, Stock

Sree Rayalaseema Hi-Strength Hypo Ltd., incorporated in the year 2005, is a Small Cap company, operating in Chemicals sector. key Products/Revenue Segments include Chemicals, Sale of Energy, Export Incentives and Scrap. The company has a total of 1.72 Crore shares outstanding whereas Promoters Holding 62.05%.

PE Ratio – 9.14, EPS- 38 according with last quarter data. Total Debt to Equity – 0.16 which is very nominal as per cash in hand. company asset quality increasing significantly and liabilities remain stable. As per companies chemical and energy product demand is very high.

Are you searching Following these question

>>sree rayalaseema hi-strength hypo ltd share price

>>sree rayalaseema hi-strength hypo ltd multibagger

>>sree rayalaseema hi-strength hypo ltd news

>>sree rayalaseema share price target

>>sree rayalaseema hi-strength hypo ltd dividend

>>sree rayalaseema hi-strength hypo ltd results

>>sree rayalaseema hi-strength hypo ltd history

>>sree rayalaseema hi-strength hypo ltd bonus

(TALBROAUTO) Talbros Automotive Components – Share Price

Talbros Automotive Components Ltd. is an auto component manufacturer. The company is engaged in the manufacture of gaskets and forgings. The company’s products include gaskets and heat shields; forging; suspension system; hoses, and anti-vibration systems. It caters to various vehicle segments, such as two-wheelers, passenger cars, light and heavy commercial vehicles, agricultural equipment, and industrial and off-road vehicles. It focuses on the supply of forgings to tractor manufacturers and vehicle manufacturers in Europe. Its products also include multi-layer steel, rubber-molded, exhaust manifolds, edge-molded, cylinder heads, housing and yoke shafts, kingpins and gear blanks. The company has manufacturing facilities located at more than nine locations in about three states in India. Its gasket manufacturing facilities are located in Faridabad, Haryana; Pune, Maharashtra and Sitarganj, Uttarakhand. Its forging manufacturing facilities are located at Bawal, Haryana.

The company has a total of 1.23 Crore shares outstanding, Promoters Holding – 58.20

P/E – 9.96, EPS -28.31, Divi. Yield – 0.71.

One good thing for company that every year company decrease its debt. Talbros has a strong order book and sales growth is robust – though its last quarter profit mildly low due to covid-19 but long term growth huge.

Related Search Query about Talbros

>>Talbros share price target

>>Talbros products

>>Talbros automotive components ltd

>>Talbros share price bse

>>Talbros share price nse

>>Talbros auto multibagger

>>Talbros auto news

>>Talbros engineering ltd

( KELLTONTEC) Kellton Tech Solutions – Share Price, Stock

Kellton Tech Solutions Ltd., incorporated in the year 1993, is a Small Cap company , operating in IT Software sector. Kellton Tech Solutions Ltd. key Products/Revenue Segments include Software Services, Other Services and Computer Hardware.

The company has a total of 9.64 Crore shares outstanding, Promoter Holding – 52.22

I hope coming year Kellton Tech Solutions – Share Price will be a multibegger stock,

company Total Debt to Equity (x)- 0.21, Kellton is related artificial intelligence with software developer, Kellton Tech Solutions Limited provides digital transformation, ERP, and other IT services worldwide. Kellton Tech Solutions undervalued compared to its fair value and its price relative to the market.

Related Query

>>kellton tech share price target 2022

>>kellton tech share price target 2021

>>why kellton tech share falling

>>kellton tech share price target 2025

>>kellton tech share price moneycontrol

>>kellton tech share good or bad

>>kellton tech screener

>>kellton tech share price bse

(Karda) Karda Constructions – Share Price, Stock

Karda Constructions Ltd., incorporated in the year 2007, is a Small Cap company, operating in Real Estate sector.

Karda Constructions Ltd. key Products/Revenue Segments include Income from Sale of Commercial Flats, Shops & Plots, Contract Revenue, Other Operating Revenue and Rental Income . The company has a total of 12.30 Crore shares outstanding. Promoters Holding 58.24%.

Currently operating in Maharashtra, order book has been showing very strong. company showing slow profit due to covid 19 situation but I hope Karda construction will come back very soon with robust performance.

presently Karda contruction PE Ratio- 8.28, EPS- 4 and most important is debt is under control against cash in hand.

Related Search

>>karda construction share price forecast 2022

>>karda construction share price target

>>karda construction share price moneycontrol

>>karda construction share price nse

>>karda construction news

>>karda construction share price history