Just to compare with record high closing figure of market capitalisation at Rs 274.69 lakh crore on October 18, 2021, the loss of investors’ wealth comes to more than Rs 32 lakh crore in a period of little more than four months.

Bears tightened their grip over global markets as Russia launched military operations against Ukraine on Thursday morning. The benchmark indices in India plunged 4.8 percent, eroding investors’ wealth by more than Rs 13 lakh crore.

The market rout took place on a day that marks the expiry day for futures and options contracts.

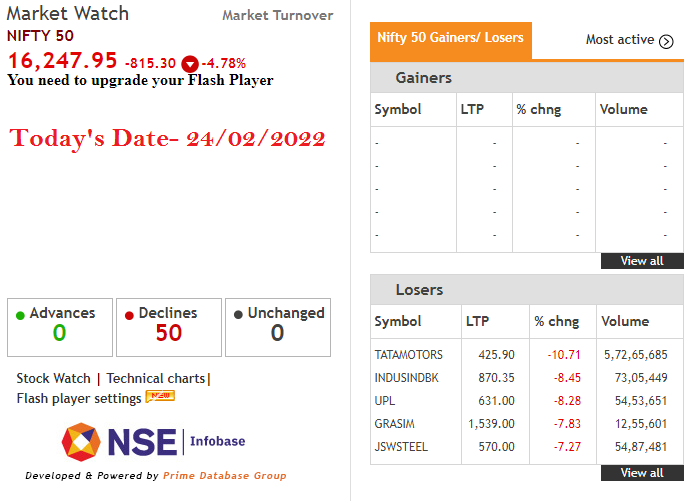

The BSE Sensex plunged 2,702 points or 4.72 percent to 54,530 and the Nifty50 cracked 815 points or 4.8 percent to 16,248, breaking the December low (16,410).

The heavy sell-off was seen across sectors with auto, bank, financial services, FMCG, IT, pharma, metal, and realty falling 3-7 percent.

Such brutal downfall usually hit small-caps and mid-caps very hard. This has clearly been reflected in the last several sessions now. On Thursday, the Nifty Midcap 100 and Smallcap 100 indices slumped around 6 percent each, while the Nifty 500 index was down over 5 percent.

All this resulted into a significant erosion in investors’ wealth. The total loss to investors in a single day was more than Rs 13.4 lakh crore. The BSE market capitalisation fell to Rs 242.2 lakh crore today, down sharply from Rs 255.6 lakh crore reported in previous session.

Just to compare with record high closing figure of market capitalisation at Rs 274.69 lakh crore on October 18, 2021, the loss of investors’ wealth comes to more than Rs 32 lakh crore in a period of little more than four months.

“The Russia-Ukraine standoff has escalated into a full-blown war. The steep decline in broader indices globally reflects panic among investors,” says Nirav Karkera, Head of Research at Fisdom.

The volatility index also moved up to the highest level since June 2020, indicating more volatile swings ahead. The India VIX, which measures the expected volatility in the market, hit an intraday high of 33.97, the highest level since June 17, 2022. It closed at 31.98, up 30.3 percent.

Apart from the geopolitical tensions, as far as India is concerned, the most critical pinch point is rising oil prices which hurts not only corporate earnings but also hits economic growth when we are thinking of recovery gaining pace after Covid-19 pandemic crisis. India imports nearly 85 percent of its oil requirements.

International oil benchmark Brent crude futures hit $100 a barrel today, for the first time since 2014. It was up more than 6 percent at $103 a barrel at the time of publishing this article.

The fear of supply chain disruption is the key cause behind the oil price rise as Russia is the third largest oil producer and second largest natural gas producer. On the other side, US and European nations already started off imposing several sanctions on Russia but there is no change in the plan of Moscow that attacked Ukraine.

With the increase in oil prices, inflation concerns will come to the fore and it is a critical situation for the Reserve Bank of India which has been giving priority to growth before beginning of policy tightening.

“The inflation situation sure is precarious and the crude saga will only add to the pain, but with the government having the ability to moderate impact through reduction in duties, some impact can be absorbed. Indian macro-economics has strengthened significantly over eight years but is not quite immune to steep increases in crude prices,” said Karkera.

On the global front, Asian peers like Hong Kong’s Hang Seng fell 3.6 percent, followed by Australia’s ASX200 down 3 percent, South Korea’s Kospi 2.6 percent, Japan’s Nikkei 1.7 percent, and China’s Shanghai Composite down 1.8 percent.

US futures are also pointing towards weak opening in the evening today. Dow Jones and S&P futures traded 2.6 percent down each, while Nasdaq futures corrected over 3 percent.

However, the safe haven gold has been on buyers’ radar, rising 1.7 percent to $1,942.1 per troy ounce.