Follow: SBI Card Advantage

SBI Card Elite

SBI card elite advantage: SBI Card Elite offers an array of thoughtful privileges and benefits to complement and reward the premium lifestyles of SBI cardholders and gives them the best in class consumer experience and service. Instant reward points, milestone benefits, exclusive concierge services, free air tickets and gift vouchers, domestic and international airport lounge access and exclusive travel benefits, complimentary movie tickets every month are just some of the benefits cardholders enjoy Can.

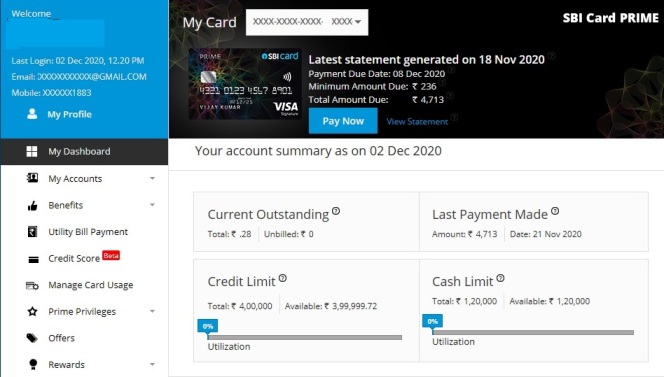

SBI Card PRIME

The SBI card PRIME, which is designed for the entry-level premium segment, offers exclusive lifestyle privileges with a distinct value in its daily expenses. SBI Card PRIME brings cardholders access to complimentary international airport lounges through membership and priority international programs for loyalty programs of marquee brands such as Vistara and Trident Hotels. PRIME card holders each Receive Rs.10 awards for. 100 was spent on food, grocery and international expenses. The card features instant reward points on the cardholder’s birthday and some favorite partners such as Reliance Fresh, Reliance Smart, Reliance Trends, Reliance Footprint and Big Basket. A garment and travel gift is eligible for a voucher upon crossing the level of certain milestones.

Simply SAVE SBI Card

Simplysave SBI Card brings unmatched value to our card holders. This card saves fuel at all petrol pumps, along with fuel surcharge waiver, as well as faster spending on dining, movie, departmental and grocery stores. This card is designed to be designed.

SimplyCLICK SBI Card

SBI Simply Click SBI Card is a unique card that provides today’s young, always online generation with an online shopping experience with eight strategic partners – Amazon, BookMyShow, Cleartrip, FoodPanda, Fabfurnish, Lanskart, Ola, and Zoomcar. Covering the major spending categories in the online space. Simple SBI Card provides instant reward points to the tune of 10X on purchases made on partner sites. Additionally, the card offers reward points to the tune of 5X on other e-commerce sites.

SBI Card Unnati

SBI Card Unnati is a unique card targeted at all SBI customers including Jan Dhan account holders across the country. SBI Card covers people with no credit history to avail Unnati Credit Card. Launched to adopt digital payments and facilitate credit inclusion, the card is offered at a zero annual fee for four years. Cardholders can avail benefits such as fuel surcharge exemption at petrol pumps in India, earning 1 reward point for every Rs 100 and cashback on achieving certain annual milestones.

SBI Signature Corporate Card

The signature corporate card has been designed keeping in mind the needs and preferences of the business traveler continuously. The complimentary Airport Lounge Entrance Program and Priority Pass membership offer the card holder a premium travel experience. Apart from the host of benefits which are already a part of the SBI Platinum Corporate Card Program, SBI Signature Corporate Card is also Provides complimentary concierge services, travel insurance and air accident insurance. 1 crore. For the organization, SBI Signature greatly simplifies the entire process of corporate credit card expense management.

SBI Platinum Corporate Card

SBI Platinum Corporate Card is the ideal new currency for India Inc. The card provides a robust expense management solution, convenience for employees and substantial savings for the organization. First features of the card industry such as, dynamic credit limits, transaction alert on international numbers, seamless transition of cards within entities other than spending control, daily spending limits, corporate level statements, dedicated corporate servicing, travel insurance, Air accident insurance, airport lounge access etc. The card also brings special offers from major international airlines, hotel chains, rental services and other travel partners. Powered by a world-class technology and servicing platform, SBI Platinum Corporate Card has also won the Visa Global Service Quality Award for Highest International Transactions.

Doctor`s SBI Card

Doctor’s SBI Card is a special credit card for doctors in association with the Indian Medical Association, the only voluntary representative organization of the modern scientific system of doctors in India. It brings an unmatched value proposition for doctors through the industry such as a INR 10 lakh professional indemnity insurance cover to protect doctors against professional risks and liabilities, medical supplies, travel websites / apps and quick 5X on international expenses. Reward Points, Complimentary Priority Pass. Membership and access to international and domestic airport lounges etc.

SBI CARD also launched co-branded card with largest partners in Indian Industries.

IRCTC SBI Card

The IRCTC SBI Card is the only loyalty-cum-travel credit card in collaboration with IRCTC, one of the largest e-commerce travel portals in Asia. Cardholders receive 10% back on railway bookings and also receive offers on retail expenses. Cardholders get 1.8% transaction fee waiver for all railway tickets booked with IRCTC SBI card. The redemption option is very convenient, as the cardholder can redeem the points online for booking free railway tickets on the IRCTC website.

TATA Cards (TATA SBI CARD)

The TATA Card Empower program combines the convenience of a powerful credit card with rewarding membership. Empowered Program is India’s first multi-brand loyalty program, which allows customers to earn points and gives them the advantage of capitalizing on these points across multiple loyalty partners such as Croma, Star Bazaar, Westside, Titan, Ginger etc. The card offers up to 5. % Price back at major Tata outlets with hassle free instant redemption at the point of sale.

TATA Star Card

Designed for a growing segment of customers who frequently purchase grocery / departmental items from organized retail stores, Tata Star Card offers an unmatched value proposition in this segment. Shopping with this card will get customers a 3.5% back price at all Star Bazaar outlets, plus an additional Rs. 500 bonuses every month through Star’s loyalty program. Joining e-gift voucher from Star of Rs. 3500 on Tata Star Platinum and Rs. 1000 on Tata Star Titanium cards as well as some other benefits of instant reward redemption cards for purchases on Star and other participating Tata outlets such as Westside, Croma, Ginger, Tanishq and Titan.

Air India SBI Card

Air India SBI Card comes in two variants – Air India SBI Signature Card and Air India SBI Platinum Card. The card is designed for frequent travelers and provides a highly rewarding experience on air travel. Cardholders get instant reward points of 20 points for every points 100 spent on Air India tickets. Additionally, 4 reward points are awarded for every 4 100 of other rewards. Bonus points are awarded upon achieving the milestone. Cardholders receive 20,000 reward points as a welcome gift. Reward points can be converted to air miles under Air India’s Frequent Flyer program for ticketing against miles. Complimentary access to domestic and international airports further enhances the travel experience of the forest.

BPCL SBI Card

BPCL SBI Card has been formulated as the most rewarding fuel co-branded credit card in the country. The BPCL SBI Card provides up to 70 liters of free fuel per year to the card holders. It bundles the maximum value on fuel with quick savings in department stores and other regular spending categories including grocery, entertainment and utility bill payments, making it the most comprehensive and rewarding credit card in its segment. Cardholders can earn rewards and save fuel at 14000 Bharat Petroleum Fuel Stations across the country, making the BPCL SBI Card the only fuel co-brand card to have such a wide reach.

Apollo SBI Card

Apollo SBI Card is India’s first co-branded credit card in the healthcare segment. Designed to meet the entire family’s health needs, the Apollo SBI Card is a leading product. The card offers complimentary OneApollo membership with discounts and savings of up to 10% on health check-ups, diagnostic services, pharmacy products, physiotherapy and more. It brings quick reward points to Apollo institutions and spending on food, entertainment and movies. Reward points can be redeemed at the Point of Sale at Apollo Health Centers or as Apollo gift vouchers. Card holders will be able to use the services and benefits in the wider Apollo healthcare ecosystem, including Apollo Hospitals, Apollo Clinics, Apollo Pharmacy, Apollo Diagnostics, Apollo Cradle, Apollo Sugar, Apollo White Dental, Apollo Spectra, Apollo Life Studios, Apollo Life Studios are included. Telehealth Services (ATHS) and Apollo Homecare.

The Apollo SBI card will comprehensively cover all the health and welfare needs of family members at various stages of healthcare journey.

Related search Query

- which sbi credit card is best

- which sbi credit card is best quora

- best sbi credit card for salaried employees

- which sbi credit card is best for emi

- types of sbi credit card

- sbi credit card details

- sbi credit card benefits

- sbi simply click credit card