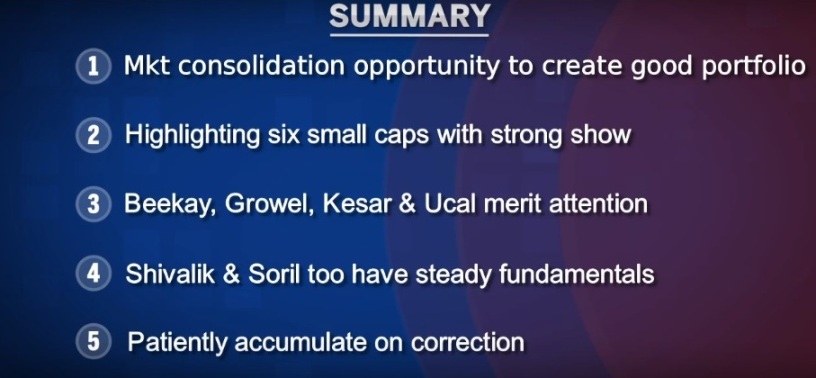

When prices are rallying, almost every small-cap stock is touted as the next blue chip in the making. Such delusions are usually cured when stock prices correct and the market enters a consolidation phase. A similar trend is playing out in the Indian market as the star small-cap stocks have fallen out favour with investors following the recent correction.

And yet, one of the cardinal rules of the stock market is that the best returns are made by buying the right companies at a time when they are ignored by the market.

We came across half a dozen smaller companies that not only reported impressive numbers in the latest quarter but also boast of healthy and steady fundamentals. Savvy investors would do well to keep these stocks on their watch list and wait for an opportunity to buy them at a good price.

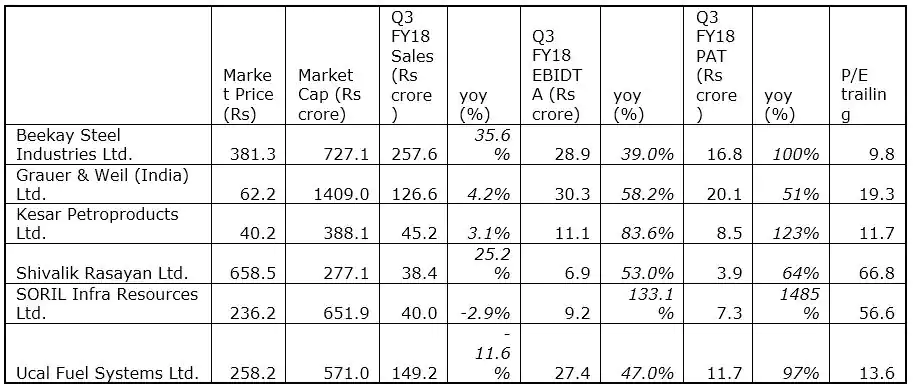

Beekay Steel Industries

Beekay Steel Industries is a customized steel manufacturing company whose products are used extensively for automobile components, engineering industries, infrastructure and railways. The company produces bright bars, structurals, TMT bars & coil springs in a variety of specifications and grades. Beekay also tailors products as per its customers’ requirements.

Beekay has successfully established its brand name over the past 15 years globally by supplying tailor made hot rolled and cold drawn materials in different shapes and sizes. The company boasts of a marquee clientele at home.

The company has been able to protect its margin across cycles and the profit reported in the first nine months of FY18 is 57% higher than the full-year profit of FY17.

Grauer & Weil (India) Ltd

Grauer & Weil Limited (Growel) is in the business of surface treatment chemicals, industrial paints, engineering services and lubricants. It is the market leader in surface treatment chemicals, intermediates and specialty electroplating chemicals. The business is fully backward integrated making it very difficult for any new players to enter this segment.

Growel caters to industries including auto, jewellery, hardware, plating on plastics, infrastructure, oil and gas and other heavy industries. Its products also find use in nuclear, defence and space sectors and counts Bhabha Atomic Research Centre, HAL and Isro among its clients.

The company has a small high margin aviation business supplying specialised components. In the paint business, it is into specialised paints which cater to pipeline coating, underground/underwater pipeline coatings etc. The engineering division offers turnkey solutions for effluent treatment.

The company also owns and operates a mall going by the name of Growel’s 101 in Kandivali, Mumbai and has a 99 year lease on 2 acres of prime Chembur land which currently houses only the R & D centre.

However, what especially caught our attention is the steady track record of performance over the years.

Kesar Petroproducts

Kesar Petroproducts, a dyes & pigment player, is one of the leading manufacturer of CPC Blue crude and its downstream products in India, and a is a remarkable turnaround story. The company has 15% market share of the Indian CPC market.

The company is vertically integrated with CPC Blue being the primary raw material for pigment blue. Kesar is moving up the value chain with Alpha Blue, Beta Blue and dye intermediates that commands a higher margin.

Growth in dyes segment is driven by textiles, leather and food. Pigments market is propelled by printing ink, paints and coatings.

China and India control over 50% of the market and since environmental norms are limiting China’s growth and raising the cost of production, Indian players are in a vantage position.

The company has no capex plans and is sitting on idle capacity and should reap the benefits of operating leverage, going forward.

Intensive environmental regulations, high water requirements, difficulty in obtaining new licenses and client stickiness creates entry barrier in the business.

Thanks to these moats, the operational performance has been very impressive.

Shivalik Rasayan

Agriculture sector is likely to be a focus area in the future. Shivalik Rasayan is one of India’s leading manufacturers of organo-phosphorous insecticides.

Shivalik is largest producer of dimethoate technical and the second largest producer of malathion technical in India having a capacity exceeding 1000 MT per year. The products of Shivalik are well established in Indian as well as foreign markets.

Malathion is a non-systemic, wide spectrum organ phosphorous (OP) based contact insecticide. It is used in the agricultural production of a wide variety of food/feed crops. Dimethoate technical is used in preparation of formulations used in the control of a broad range of insect pests and mites.

The company has a high promoter holding (nearly 61.7%), very healthy balance sheet and has grown earnings at a CAGR (compounded annual growth rate) of 41% in the past three years.

Shivalik also has a significant stake (37.6%) in Medicamen Biotech, a BSE-listed company and the value of this stake itself is more than its current market cap.

Soril Infra

Coming from the house of Indiabulls (promoters hold stake of 73.85% in the company), Soril Infra Resources is primarily engaged into the business of providing property and facility management services, rental services of plant and machinery etc. It is one of the largest equipment rental companies in India with a pan India presence.

There is a huge business opportunity and potential in the business of providing property & facility management services as demand from high-end service sectors is on the rise. The demand from rising number of multi storied high-end residential, commercial & retail space will also provide growth opportunities for the company.

The rental business of plant and machinery in the space of infrastructure development, which includes renting of tower cranes, passenger cum material hoists, boom placers, hoists, transit mixers, dumpers, excavators, formwork etc. has huge business potential & scope for further business development.

The presence in such high growth businesses makes it a stock to watch out for.

Ucal Fuel

Ucal Fuel system offers comprehensive fuel management systems for automotive sector. The company is jointly promoted by Carburettors Limited, a pioneer in manufacture of carburettors and mechanical fuel pumps in India and Mikuni Corporation of Japan, an internationally renowned company for Fuel Management System and products.

The company manufactures carburettors, mechanical fuel pumps and air suction valves using advanced technology. It designs product for petrol and diesel engine application.

With the company becoming Euro VI complaint in relation to pumps it is expected that exports of the same will increase. UCAL has large scope for exports and the there exists a large domestic market for spares to benefit from. UCAL’s client list includes some of the top OEMs (original equipment manufacturer) such as Maruti, Hyundai, Cummins, Bosch , TVS Motor Company, Bajaj Auto, Suzuki, Yamaha, Hero Motors etc.

These stocks should form a part of investors watch list for accumulation in the corrective phase of the market.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own, and not that of the website or its management. Trulia.in advises users to check with certified experts before taking any investment decisions.

Related search Query

- moneycontrol stock recommendations today

- Indian stock target price list

- broker research reports moneycontrol

- foreign brokerage house recommendations

- best broker research reports in india

- best stock target price

- moneycontrol intraday stocks for tomorrow

- Indian stock research reports free