Gujarat Gas (CMP: Rs 669.75, Market Capitalisation: Rs 46,618 crore) is the largest city gas distribution (CGD) company in India, and covers 23 districts in Gujarat and has a presence in six states.

Gujarat Gas has operations in 27 GAs (geographical areas). GGL provides gas to 15.5 lakh households, 4,000 industrial consumers, 17,000 commercial consumers and sells CNG through its 559 outlets.

Industrial and commercial business segment

Gujarat Gas is the biggest CGD player in India, with daily volumes of 12 mmscmd. Volume mix is skewed in favour of industrial and commercial segments, with a share of 79 per cent of total volumes, the biggest among peers and the rest from CNG/PNG domestic customers.

In 2019, the National Green Tribunal directed the Gujarat Pollution Control Board to cease operations in all businesses running on coal in Morbi (Gujarat) and charge a penalty from businesses not complying with the order.

As an immediate impact, industrial units shifted to gas for their energy requirements. Average gas consumption in Morbi is around 7 mmscmd, up from 2.5mmscmd. On an overall basis, Morbi accounts for 60-70 per cent of the Gujarat Gas’s total volumes, 76 per cent of industrial and commercial volumes. Within this, the Morbi-centred ceramic businesses account for 90 per cent of this volume.

Gujarat Gas meets its industrial and commercial gas segment demand through a mix of long-term LNG contracts with British Gas, RasGas and spot LNG market.

Its long-term contracts are Brent crude / JCC crude-linked (14 per cent to Brent & 12.7 per cent to JCC benchmark). Industrial volumes grew at a CAGR of 13.3 per cent from 2016-21 and 19.4 per cent from 2018-21, reflecting the acceleration in gas adoption.

The commercial segment is small and its growth largely remained weak with a CAGR of -3.7 per cent from 2016-21. The company won seven new GAs in Petroleum and Natural Gas Regulatory Board’s (PNGRB) 9th and 10th rounds of bidding. Development of these areas will drive growth in the medium to long term.

CNG business in India

The CNG business accounts for 14 per cent of the total volumes and less than a fifth of sales value. Being a priority sector, it enjoys a supply of cheap domestic APM gas and contributes a higher margin to the business to offset lower margins from the industrial and commercial segments.

Gujarat Gas has 559 CNG stations catering to 10 million vehicles in Gujarat. CNG prices are roughly 35-40 per cent cheaper than petrol/diesel, and it is sufficient incentive to promote personal vehicle conversion from petrol to CNG. Additionally, owing to a large number of CNG stations, waiting time at outlets are much lower than in Delhi and Mumbai.

Near-term headwinds of Gujrat gas

Imported LNG is Gujarat Gas’s largest source and has a sizeable impact on margins. From 2018 onwards, crude oil prices have remained soft, and, hence, LNG, whose price is crude-linked, has remained low, leading to better margins for Gujarat Gas.

February 2021 onwards, crude oil prices began its upward trajectory and has gained 43 per cent year to date (YTD). Hence LNG prices have also moved up, which is reflected in the record high spot Asian LNG prices at $14/MMBtu.

Historically, Gujarat Gas has managed gross margin through a combination of LT (long-term) LNG and cheap spot LNG.

This opportunity is now limited as a heatwave in the Pacific Northwest and record demand from China boosted LNG prices across the world, and, hence, Gujarat Gas faces headwinds in the near future that may impact its margins.

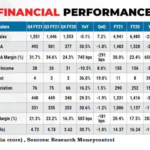

We estimate that in an expected scenario of the upward revision in domestic APM gas prices in September and continued north movement of Crude/LNG prices would mean a 33.7 per cent surge in raw material costs and a 5 percentage point decline in gross margin in FY22E.

With improvement in volumes and cost-efficiency, FY23 EBITDA margin is likely to remain above 20 per cent despite a 320 bps estimated contraction in FY22, and EBITDA/scm is expected to decline by 10 per cent to Rs 5.4/scm in FY22 and increase by 13 per cent in FY23 to Rs 6.1/scm.

Q4 performance of Gurat Gas

Q4FY21 volumes came in at 12 mmscmd, up 20.7 per cent year-on- year (YoY) and 3.7 per cent, sequentially. The strong demand in CNG and PNG industrials drove the volume growth, negating the limited impact of weak demand in PNG commercial volumes.

EBITDA/scm grew by 8 per cent but declined by 13 per cent to Rs 5.1/scm as higher spot LNG price raised the cost of gas to Rs 24.4/scm. Blended realisation was up 6.6 per cent/16.9 per cent to Rs 31.4/scm on a YoY/QoQ basis.

COVID restrictions led to a 20 per cent decline in daily sales volume and will be reflected in Q1FY22 results. The acquisition of Amritsar and Bhatinda Gas at a valuation of Rs 160 crore was approved by the board.

Investment case Gujrat Gas

Gujarat Gas’s volumes grew at a CAGR of 14.7 per cent during 2018-21 and are expected to grow at a CAGR of 16.7 per cent over 2021-24E. PNG volumes account for 86 per cent of the volume mix and have been driving growth over the years.

PNG volumes have grown at a CAGR of 18 per cent during 2018-21 and estimated to grow at a CAGR of 17 per cent over the next 2-3 years. Given its size and monopoly in a key market, Gujarat Gas is a key beneficiary of the upsurge in the CGD sector.

It should gain from an acceleration in demand due to the regulatory push and India’s long-term plan to source 15 per cent of energy requirement from natural gas. Additionally, Gujarat Gas has multiple new GAs under development, which is likely to augment total demand.

Double-digit sustainable volume growth and presence in lucrative industrial GAs augur well for Gujarat Gas’s future. It has gained 79 per cent YTD and has a potential for another 10-15 per cent price rise.

Valuation of Gujrat Gas share price

At the current price of Rs 669.75, Gujarat Gas trades at FY23e PE of 25.3x, which appears to be justified for a business with a double-digit volume growth profile and exposure to the lucrative industrial segment. We recommend investors with a long-term view to accumulate the stock.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own, and not that of the website or its management. Trulia.in advises users to check with certified experts before taking any investment decisions.

TAG: #city gas distribution #Earnings analysis #Gujarat Gas Co Ltd #moneycontrol analysis #Moneycontrol Research

Related search Query

- Gujarat gas share price target 2022

- gujarat gas share split

- why gujarat gas share price down

- gujarat gas share price target 2021

- gujarat gas share price target tomorrow

- gujarat gas share price target 2025

- gujarat gas share price target motilal oswal

- gujarat gas company limited latest news