The Life Insurance Corporation of India has recently rolled out its Saral Pension, a standardised non-linked, non-participating immediate annuity plan that all life insurers have to offer. Several other life insurance companies such as Max Life, Tata-AIA Life and Aegon Life have already launched their products. This, after the Insurance Regulatory and Development Authority of India (IRDAI) made it mandatory for insurance companies to devise these plans, in line with other standardised products in the life and health insurance categories, from April 1.

All features and clauses are the same across insurers, but the annuity rates are left to the companies.

How do Insurance annuities work?

Buying an immediate annuity plan after paying a lump-sum entitles you to receive regular pension – yearly, quarterly, half-yearly or monthly – throughout your lifetime. You have to use your accumulated retirement corpus to hand over a one-time lump-sum to the life insurer. This is known as the purchase price. The insurance company then promises lifelong pension at a pre-decided rate, in the simplest option. If term insurance covers the risk of the policyholder dying early, annuity does the opposite – it covers individuals’ longevity risk.

Saral Pension A simple retirement plan

Saral Pension plan comes with two options: ‘Life annuity with return of 100 percent of purchase price’ and ‘Joint life last survivor annuity with return of 100 percent of purchase price on death of the last survivor.’ Under option one, the policyholder will receive regular pension during her lifetime. After her death, the purchase price will be handed over to the nominees or legal heirs. If she chooses the second option, her surviving spouse will continue to receive the annuity even after her death. The purchase price will be paid out to her nominees or legal heirs after the surviving spouse’s death. There is also an option to surrender the policy in case you contract a critical illness such as cancer or renal failure, besides provision for taking a loan six months from policy purchase.

All other features being the same, the rate of return is the only distinguishing factor. Currently, the returns being offered by life insurers range from 4.6-6.2 percent, depending on the age at entry and amount invested.

Related search Query

>sbi saral pension plan disadvantages

>lic saral pension yojana 2021 details

>lic saral pension plan review

>lic saral pension plan example

>lic saral pension plan calculator

>lic saral pension yojana 2021 interest rate

>lic saral pension plan interest rate

>saral pension yojana 2021 calculator

LIC vs peers

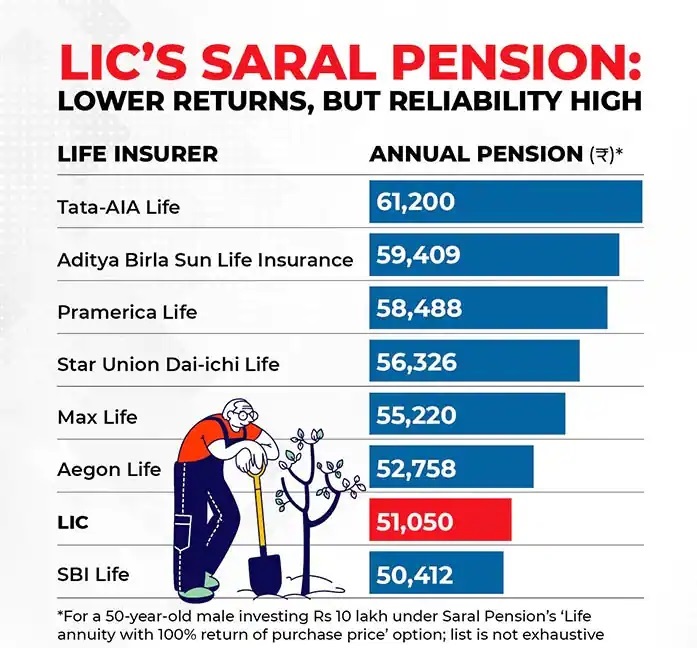

A comparison of annuity across insurers shows that most insurers on the list offer better rates than LIC, with Tata-AIA Life’s annuity rate being substantially higher. It promises an annual pension of Rs 61,200 compared to LIC’s Rs 51,050 for a 50-year-old investing Rs 10 lakh and choosing option one. But, the gap between annuity rates of LIC and other insurers is even narrower

“Many see LIC as a reliable brand that will fulfil its commitment and do not mind compromising on the returns. Put simply, your decision will depend on the parameter that is most important for you. LIC has a long-term track record of paying claims and enjoys people’s trust. On the other hand, if returns matter more to you and the difference is significant – like in case of Tata-AIA’s product – you can look at those companies, too. A minor difference in returns will not matter, given that these are annual payouts,” says Suresh Sadagopan, Founder, Ladder7 Financial Advisories.

Under annuity plans, the life insurer has to make the pay-outs over long periods of time and, hence, its capacity to generate returns is inherently limited. “Modest returns apart, the fixed nature of annuity payouts is a restrictive factor. The value of Rs 50,000 pension ten years later will be far lower than what it is now. But, inflation-adjusted annuities are not on offer,” points out Raghvendra Nath, Managing Director, Ladderup Wealth Management. Yet, annuity can be a source of assured income and comfort to pensioners post retirement. “Those with modest income of Rs 60,000-70,000 a month should definitely opt for an annuity product that will get them maximum pension throughout life. However, it may not be a good idea for high-networth individuals looking at such products purely from an investment perspective,” he adds.

Annuity can be a source of comfort during retirement years, as it assures income for the annuitant’s lifetime, as also the spouse’s. In the current structure, annuity income, including the principal component, is taxed at the marginal rates. The lack of inflation-linked increasing annuity option is another dampener. However, if you remain convinced about an annuity’s utility value and are only evaluating insurers, LIC does hold an edge over most other companies, despite the lower annuity rate. Like in the case of pure life insurance claims, your life insurer’s ability and willingness to make regular payments over the long term constitute crucial determining parameters.