What is the latest Coal India News about Debt?

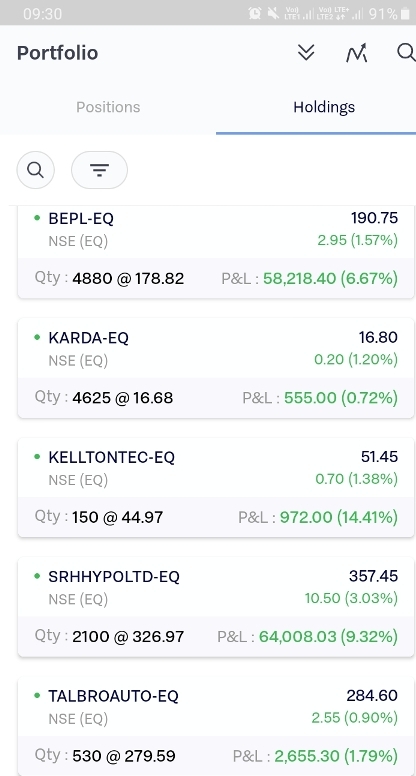

Coal India had ₹58.8b of debt in March 2021, down from ₹64.3b, one year before. However, its balance sheet shows it holds ₹232.9b in cash, so it actually has ₹174.1b net cash.

Warren Buffett famously said, ‘Volatility is far from synonymous with risk.’ It’s only natural to consider a company’s balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Coal India Limited (NSE:COALINDIA) does use debt in its business. But is this debt a concern to shareholders?

Liabilities of Coal India limited

Zooming in on the latest balance sheet data, we can see that Coal India had liabilities of ₹516.4b due within 12 months and liabilities of ₹731.8b due beyond that. Offsetting this, it had ₹232.9b in cash and ₹295.2b in receivables that were due within 12 months. So it has liabilities totalling ₹720.1b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its very significant market capitalization of ₹887.7b, so it does suggest shareholders should keep an eye on Coal India’s use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. While it does have liabilities worth noting, Coal India also has more cash than debt, so we’re pretty confident it can manage its debt safely.

In fact Coal India’s saving grace is its low debt levels, because its EBIT has tanked 20% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Coal India Stock can strengthen its balance sheet over time.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Coal India has net cash on its balance sheet, it’s still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Coal India reported free cash flow worth 13% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Coal India dividend I Coal India dividend 2021

Interim Dividend – Rs 5 Per Share15-Mar-2021

Interim Dividend – Rs 7.50 Per Share19-Nov-2020

Interim Dividend – Rs 12 Per Share19-Mar-2020

Conclusion Coal India share price

While Coal India does have more liabilities than liquid assets, it also has net cash of ₹174.1b. Despite its cash we think that Coal India seems to struggle to grow its EBIT, so we are wary of the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet.

Related search Query

- Coal India share price target 2022

- Coal India share price target 2025

- Coal India dividend 2021 record date

- Coal India share price target 2021

- Coal India share is good for long term

- Coal India bonus news

- Coal India share dividend

- why is Coal India share price falling