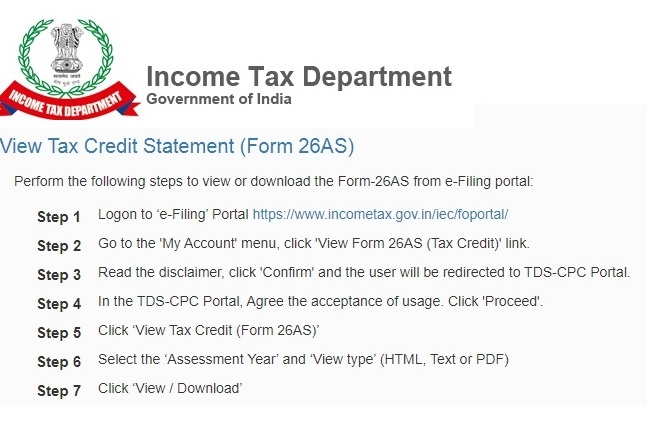

Income Tax Form 26AS new changes : The Central Board of Direct Taxes (CBDT) has added some new things in Form 26AS. This includes details of purchases of mutual funds, remittances, as well as income tax returns of other taxpayers. It will be available for taxpayers in their Form 26AS. Form 26AS is an annual consolidated tax statement. Taxpayers can access it from the Income Tax website using their Permanent Account Number (PAN).

The Central Board of Direct Taxes (CBDT) on 26 October ordered inclusion of new details in the information reported in the new Form 26AS under section 285BB of the Income Tax Act.

Form 26AS: These details included

The details included in Form 26AS include money remitted abroad through authorized dealer of any person, details of salary along with deduction claimed by the employee, information in ITR of other taxpayers, on income tax refund Interest is the information published in the details of financial transactions. In addition, information on off-market transactions on behalf of the depository/registrar and ‘transfer agent’, mutual fund dividends reported from RTAs and purchases of mutual funds will also be included in Form 26AS.

CBDT has authorized the Director General of Income Tax (Systems) to upload the information. For this, the next three months have been given from the end of this month.

Section 285BB was introduced in the budget

In the Budget 2020-21, a new section 285BB of the Income Tax Act was introduced. In which it was said to include details other than TDS / TCS by making changes in Form 26AS. Now Form 26AS will contain details of specified financial transactions, tax payment, demand/refund and pending or other pending information.

Om Rajpurohit, Director (Direct and International Tax), AMRG & Associates said that the additional information in the Annual Information Statement in Form 26AS will make the assessment easier without having to face-to-face with the officials. He said that although the additional tax contribution from the taxpayers will be negligible, but its cumulative effect is better. This change will make a system of self-declaration and accurate information about earned income for all taxpayers.