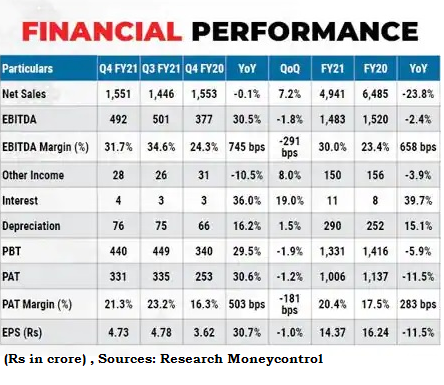

Indraprastha Gas Ltd (IGL; CMP: Rs 534.70; Market Capitalisation: Rs 37,348 crore) reported a mixed set of numbers, with Q4FY21 EBITDA rising by 31 per cent to Rs 492 crore and total volumes at 614 mmscm (8.3 per cent YoY & 6.6 per cent QoQ).

EBITDA/scm was at Rs 8, up 21 per cent over Q4FY20, largely due to a record fall in crude oil and gas prices. Revenue grew 7 per cent over Q3FY21 but remained flat on a YoY basis at Rs 1,551 crore. The EBITDA margin expanded by 745 basis points over the last year to 31.7 per cent, but below the 34.6 per cent in Q3FY21.

The improvement in EBITDA margin was aided by a reduction in raw material costs, which declined to 7.2 per cent points over Q4FY20. Employee costs were 2.1 per cent lower over the same quarter last year.

The spread between revenue and cost continued to remain above the levels seen in FY2020, largely owing to weak crude and gas prices during the year. The company declared a dividend of Rs 3.6 per share (up 29 per cent YoY), implying a dividend yield of 0.7 per cent.

Segmental updates

During Q4FY21, total volume grew at 8.3 per cent YoY and 6.6 per cent sequentially to 614 mmscm (6.82 mmscmd). Within this, CNG volume grew a tad slower at 7.1 per cent/6.3 per cent to 438 mmscm (4.9 mmscmd).

PNG segment volume picked up pace and grew by 11.4 per cent over Q4FY20. This acceleration was fuelled by the industrial/commercial segments, which jumped 18.7 per cent to 89 mmscm over the same quarter last year. Domestic segments grew at 9.8 per cent, both sequentially and on a YoY basis to 45 mmscm.

Realisations

Q4FY21 blended realisations remained muted and were down 7.7 per cent YoY, flat sequentially at Rs 25.3/scm, owing to the weakness in CNG realisations as COVID-induced lockdowns impacted public transportation, leading to the slowest growth in CNG buses in five years (2.3 per cent in FY21). PNG segment realisations were also anaemic at Rs 25.9/ scm, down 5 per cent YoY but up 3.7 per cent QoQ.

Long-term drivers

India’s plan to transform its energy mix in favour of cleaner sources remain the biggest driver for gas E&P and utilities businesses. The government envisions the share of natural gas in the energy mix to go up to 15 per cent from 6 per cent by 2030.

This increase in gas consumption is likely to be propelled by the CGD sector. IGL is among the best-placed which enjoys a monopoly in operations. At present, around 69 per cent of its revenue comes from CNG, which continues to remain cheaper than petrol and diesel.

Additionally, the focus on air quality issues in the Delhi NCR region has forced the government to ask all industries to switch to gas, a net gain for IGL. IGL’s CNG/PNG volumes have grown at a CAGR of 10 per cent/13 per cent (2015-20) and it is estimated to maintain the upward trajectory as CNG prices are still economical in comparison to petrol/ diesel prices.

Stock performance so far

IGL has gained 5.43 per cent year-to-date (YTD) and 4.62 per cent from the pre-COVID peak in February 2020, in contrast to the Nifty50, which has gained 12 per cent/ 30 per cent YTD since February 2020. IGL’s underperformance against Nifty50 was partially because of the COVID impact on automotive fuels i.e., CNG, as the Delhi NCR, like the rest of the country, came to a standstill during the lockdowns in the first wave and the second wave of COVID-19.

As COVID restrictions are being lifted, daily volumes have already recovered above the pre-pandemic levels and revenue as well as realisation are also on track to recovery.

Valuations

At the CMP price of Rs 534.70, IGL trades at a FY23 PE of 26.6x, which, we believe, is fair, given a stable business like IGL, with zero debt on its books, monopoly in operations and long-term growth drivers, coupled with a double-digit CAGR (2015-20) profile in volumes and earnings.

Moneycontrol recommend investors with a long-term view to accumulate the stock on declines.

About Indraprastha Gas

IGL is India’s second-largest CGD company, operating in Delhi NCR. It supplies 6.82 mmscmd gas and caters to a fleet of 1.26 million CNG vehicles, 612 CNG stations, and 16.85 lakh PNG consumers. The company has a 50 per cent stake each in Central UP Gas Ltd (CUGL) & Maharashtra Natural Gas Ltd. IGL won multiple areas in the 10th round of bidding by the Petroleum and Natural Gas Regulatory Board (PNGRB).

Key risks of IGL

Significant changes in APM gas prices and competition in Delhi NCR region, once PNGRB notifies open access, are the two key risks.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own, and not that of the website or its management. Trulia.in advises users to check with certified experts before taking any investment decisions.

Related search Query

- Indraprastha share price

- igl share price nse

- adani gas share price

- why igl share price dropped

- mgl share price

- igl share price target 2022

- bharat gas share price

- mgl share price moneycontrol