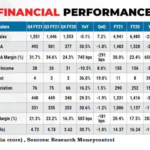

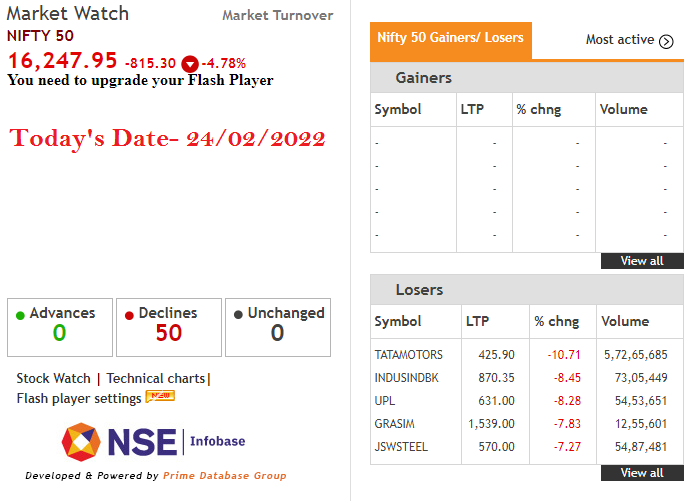

One of the few companies that could sail through the turbulent times of the COVID pandemic is Amar Raja Bettery share (CMP: Rs 744, Mcap: Rs 12,700 crore, Nifty: 15,680), making it our tactical pick for this week. Moreover, in our view, the 28 per cent correction from the recent high of Rs 1025.55 hit on February 15 gives an entry opportunity to investors.

The correction has been led by demand concerns due to the second wave of Covid. However, we believe, like last year, this disruption is temporary and demand will bounce back once different states lift lockdown restrictions.

There are several factors that make us upbeat about the company.

With the reduction in the number of fresh Covid cases and a ramp-up in vaccine doses administered, demand is expected to bounce back sharply.

Related search Query

>Amara raja batteries share price target 2022

>Amara raja share price forecast

>Amara raja batteries share price target 2021

>Amara raja share price target 2025

>Amara raja batteries latest news

>Amara raja share nse

>Amara raja share price history

>Amara raja share price target tomorrow

Two-wheelers and passenger cars are expected to see a significant pent-up demand like last year once localised lockdowns are lifted. Further, the preference for personal transport will continue to be a key growth driver.

The commercial vehicle (CV) segment has also started catching up fast. In fact, the Union budget had promised a huge increase in investment to revive economic growth, which is expected to boost CV demand.

With the economy trying to return to normalcy, the industrial segment is seeing significant traction. As government investment in these pockets pick up, the demand for batteries is expected to see a strong uptick.

Further, what continues to help battery manufacturers to sail through the pandemic smoothly is the pick-up in demand in the replacement segment. These companies generate significant revenues from this segment. Around 45 per cent of the total revenue of ARBL comes from replacement demand.

Moreover, ARBL is coming up with a 100-megawatt hour lithium-ion battery plant in Andhra Pradesh to charge up its EV strategy. It has already launched e-rickshaw battery and expects sales to pick up this fiscal.

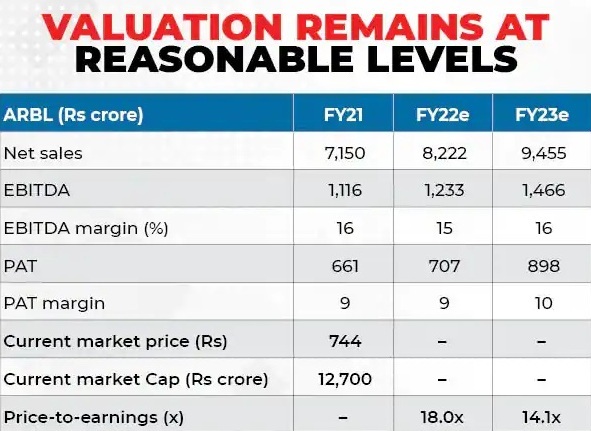

However, rising lead price continues to be a concern and, if the uptrend continues, operating margins of these companies may come under pressure. ARBL, has earmarked an outlay of Rs 280 crore for backward integration to save costs. So it is unlikely to impact margins in the long run.

In terms of valuations, ARBL is now trading at 14.1 times FY23 projected earnings.

Risks of Amara Raja Batteries share

Any weakness in the automotive segment can adversely affect the financial performance of the companies. Further, any rise in raw material prices and an adverse movement of the rupee against the dollar could also hurt operating profitability.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own, and not that of the website or its management. Trulia.in advises users to check with certified experts before taking any investment decisions.