How Healthy Is Bharti Airtel’s Balance Sheet?

The latest balance sheet data shows that Bharti Airtel had liabilities of ₹1.12t due within a year, and liabilities of ₹1.45t falling due after that. Offsetting this, it had ₹330.1b in cash and ₹45.8b in receivables that were due within 12 months. So it has liabilities totalling ₹2.19t more than its cash and near-term receivables, combined.

This is a mountain of leverage even relative to its gargantuan market capitalization of ₹2.84t. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Bharti Airtel has a quite reasonable net debt to EBITDA multiple of 2.1, its interest cover seems weak, at 1.7. In large part that’s it has so much depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it’s safe to say the company has meaningful debt. Notably, Bharti Airtel’s EBIT launched higher than Elon Musk, gaining a whopping 150% on last year. There’s no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Bharti Airtel can strengthen its balance sheet over time.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it’s worth checking how much of that EBIT is backed by free cash flow. In the last three years, Bharti Airtel basically broke even on a free cash flow basis. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

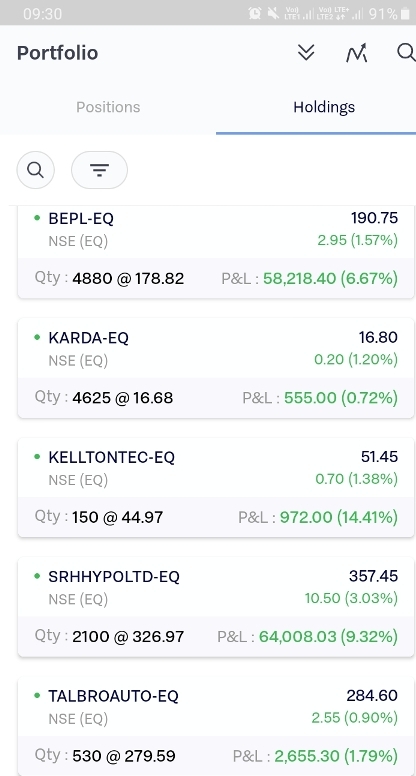

A 0.4% yield is nothing to get excited about, but investors probably think the long payment history suggests Bharti Airtel has some staying power. Some simple research can reduce the risk of buying Bharti Airtel for its dividend – read on to learn more.

Bharti Airtel paid out 93% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow.

Dividend Volatility of Bharti Airtel

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinize the last decade of Bharti Airtel’s dividend payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was ₹1.0 in 2011, compared to ₹2.0 last year. Dividends per share have grown at approximately 7.2% per year over this time. The dividends haven’t grown at precisely 7.2% every year, but this is a useful way to average out the historical rate of growth.

It’s good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Bharti Airtel might have put its house in order since then, but we remain cautious.

Bharti Airtel Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Bharti Airtel’s EPS have fallen by approximately 78% per year during the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Bharti Airtel’s earnings per share, which support the dividend, have been anything but stable.

We’d also point out that Bharti Airtel issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus – perpetually pushing a boulder uphill. Companies that consistently issue new shares are often sub optimal from a dividend perspective.

We’re a bit uncomfortable with Bharti Airtel paying a dividend while loss-making, especially since the dividend was also not well covered by free cash flow. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Using these criteria, Bharti Airtel looks quite suboptimal from a dividend investment perspective.

Related search Query

- Bharti airtel share price target 2022

- Bharti airtel share price target 2025

- Bharti airtel news

- Bharti airtel share price target 2021

- Bharti airtel share price target motilal oswal

- jio share price

- Bharti airtel owner

- Bharti airtel subsidiaries